benefit in kind lhdn

Section 62 3 ITEPA 2003. BENEFITS-IN-KIND Public Ruling No.

8 Tax Deductions That May Save You Some Cash In 2022

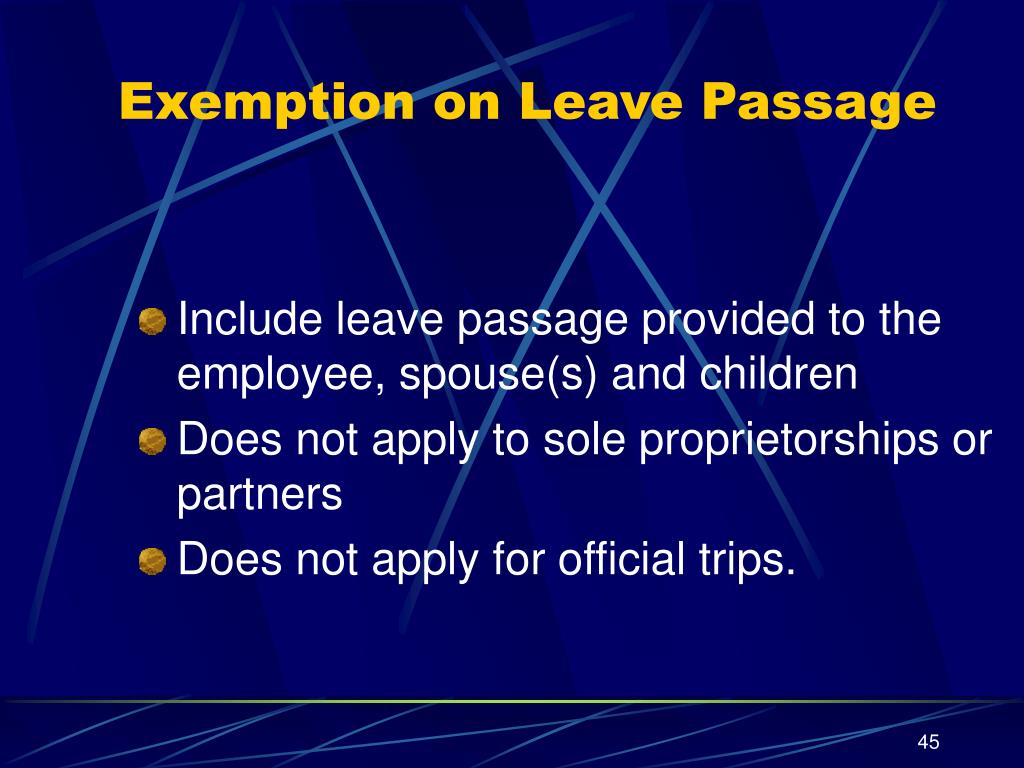

Tax exemption on benefits-in-kind received by an employee 21 Benefits-in-kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from.

. 22004 Date of Issue. Superceded by the Public Ruling No. Benefit In Kind is a non-cash allowance.

7 months 3 weeks ago 4098. Benefits-in-kind are benefits provided by or on behalf of your employer that cannot be converted into money. These non-monetary benefits are considered as income to the.

Benefits in Kind - LHDN was created by Chian Wei. 8 November 2004 INLAND REVENUE BOARD MALAYSIA _____ b. Benefits-In-Kind dated 15 March 2013.

Kakitangan has provided a real. BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. Motor cars provided by employers are taxable benefit in kind.

Generally non-cash benefits eg. Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car. Benefits used by employer to perform employment duties.

Motor cars provided by. The most common type of Benefit In Kind are. Benefits in kind are non-monetary benefits that are given to an employee during their period of service in the company.

Benefits and monthly bills for fixed line. Hi Kap-Chew Would ask for your favourite how to set the benefits in kind for the Director in. Discounted price for consumable business productsservices of employer.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. VALUE OF BIK PER YEAR. This means that when the benefit is provided to the employee that benefit cannot.

An employee may benefit from their employment by receiving a benefit that does not take the form of money. This benefit is treated as income of the employees. Such profits are often called benefits in kind.

It sets out the interpretation of the Director General of Inland. Telephone including mobile phone i Hardware - fully exempt ii Bills - fully exempt. Paragraph 3 Item 1 of Appendix 2 Telephone bill benefit Payer Tax treatment Where telephone is subscribed by the employer Employer The benefit is.

Accommodation or motorcars provided by employers to their employees are treated as income of the employees. Benefits in kind will be subject to the levy from 202324. A benefit in kind is a taxable item an employer might purchase or provide for their employees in addition to their salaries.

Any appointment or office whether public or not and whether or not. Up to RM2500 for self spouse or child. What should I be aware of.

Currently employers NIC due on benefits in kind is paid following the end of the relevant tax.

What Is Form Ea Part 1 Defining The Benefits In Kind

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

Covid 19 Lhdn Provides Tax Relief For Vaccinations Screenings Under 2021 Assessment The Star

What Is Bik Benefit In Kind Bik Income Tax Malaysia Sql Payroll Hq

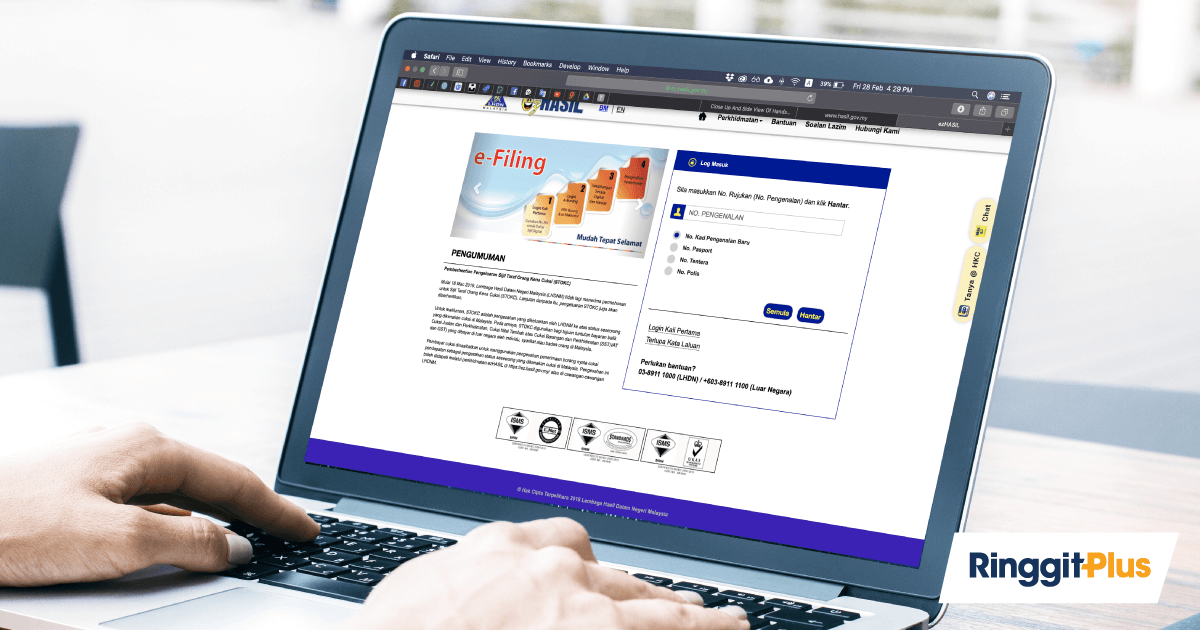

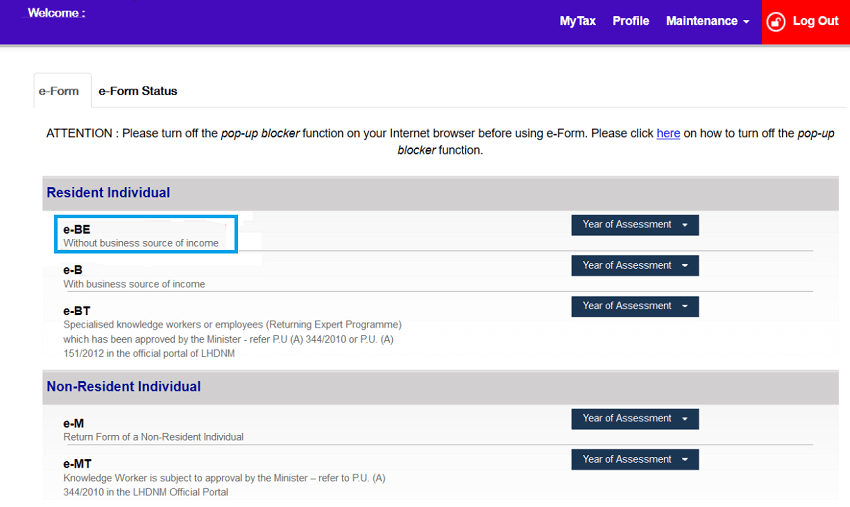

Lhdn E Filing Your Way Through Tax Season Properly

Personal Income Tax Interest Income Tax Treatment

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Tax Exemptions What Part Of Your Income Is Taxable

Employer S Tax Reporting Subang Pages 51 100 Flip Pdf Download Fliphtml5

Group Training Classes Total Running Club

Solved Subject Knowledge Managementin Real Working Chegg Com

Mcdonald Hopkins 2017 High For Business Optimism Carries Into 2018 Crain S Cleveland Business

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Ctos Lhdn E Filing Guide For Clueless Employees

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Tax Exemption On Tablet Related Benefit Perquisites Vs Bik

0 Response to "benefit in kind lhdn"

Post a Comment